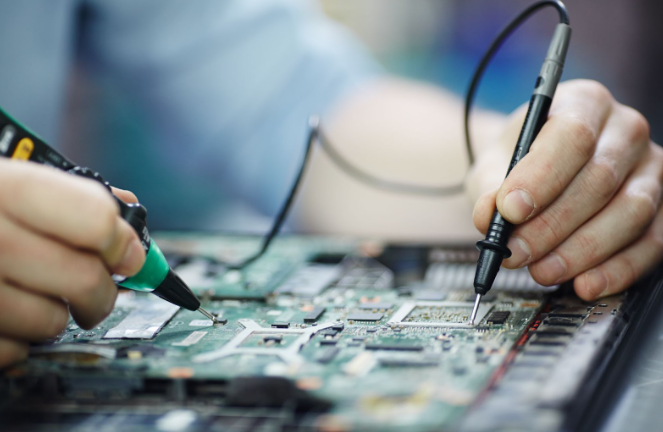

Picture Source: pressfoto on Freepik.com

India’s domestic electronics manufacturing services (EMS) industry revenues are on track to more than double, reaching $55 billion by FY2027.

This growth is driven by increased local sourcing of components and the expansion of global companies like Apple, Samsung, and Lenovo in India.

Apple and Samsung to Boost Investments

A BNP Paribas report forecasts that Apple will ramp up its investment to $40 billion over the next 4-5 years to significantly boost its production capacity in India.

Similarly, Samsung plans to expand its manufacturing presence beyond smartphones to include laptops.

Lenovo and Other Global Players Expand Operations

The report also highlights IT hardware giant Lenovo’s plans to manufacture servers in India to support its growing data center business, leveraging the production-linked incentive (PLI) scheme for IT hardware.

Other global companies such as Acer, HP, and Nokia are also expanding their operations in India, according to BNP Paribas.

Domestic EMS Market Growth

The total addressable market for domestic EMS players, estimated at $40 billion as of FY23, is projected to grow at a 27% compound annual growth rate (CAGR), reaching $100 billion by FY27.

This growth is fueled by declining imports of finished goods, growing component production, and a focus on local manufacturing.

“While the pace of imports of finished goods (particularly mobiles, TVs, and ACs) has slowed in recent years, the electronics industry remains dependent on imports, especially for consumer and industrial electronics components, IT hardware, and LED components,” the report stated.

Government Initiatives and Industry Growth

India’s electronic manufacturing industry has seen its aggregate revenue grow rapidly from $25 billion in FY2013 to $100 billion in FY2023.

This growth is attributed to lower value-added manufacturing capabilities and various government initiatives, including customs duties on imported finished goods and production-linked incentive schemes.

Policy Continuity and Future Proposals

Industry executives emphasize the importance of policy continuity to sustain growth momentum. They also call for new initiatives, such as a PLI scheme for components and wearables. The industry has proposed a Rs 30,000-35,000 crore PLI scheme for components and sub-assemblies, along with capital expenditure support to boost domestic value addition to 35-40% from the current 18%.

Ashok Chandok, President of the India Electronics and Semiconductor Association, told ET, “The new government should now take up and evaluate the proposals to set up semiconductor fabs and continue to provide financial support and incentives to the industry.” He also stressed the need to focus on creating a component ecosystem, championing local product design through R&D, and supporting the sector with the necessary skills through international knowledge transfer